What is a U.S. LLC and why should it be a suitable option for your needs?

Limited liability companies (LLCs) are a popular business structure in the USA that offer limited liability protection to their owners. They are also flexible and can be used for a variety of businesses. If you’re looking for a business structure that offers both liability protection and flexibility, an LLC may be a good option for you.

What are the main advantages of forming an LLC in the United States?

Turn your business aspirations into reality. You can set up your business fairly quickly, even if the company’s directors are non-resident. With our broad network of local contacts, we are confident in finding the best solutions for your business in one of the US States jurisdictions to suit your particular requirements.

Limited liability protection

The owner/s of an LLC business are protected and not personally liable for the debts and liabilities of the business. This means your personal assets are not at risk if your LLC business faces Bankruptcy or Lawsuits.

Flexibility in taxation

An LLC can be taxed as either a corporation or a partnership (LLP) This gives the owners flexibility on how they want to be taxed.

Simplicity in formation and operation

LLC companies are relatively easy to form and start trading. There are few complicated corporate formalities to follow.

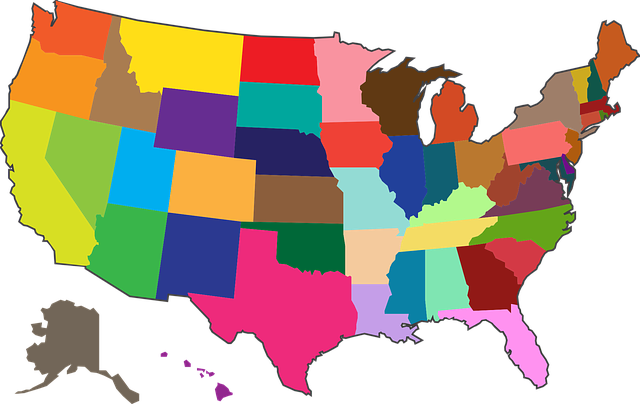

Choose a State and start your business in the USA now!

What are the advantages and disadvantages of each State?

Select a State and learn all the important information about why to start an LLC there.

Form your LLC as a non-US resident

Learn how to start your business in the USA if you are a non-US resident. Detailed information is available here. Forming a US LLC can be a valuable asset for non-US residents who are looking to expand their businesses into the US market.

What are the steps for an LLC formation if you are a non-US resident?

Choose a Suitable State for your LLC Formation

Choose a Unique LLC Name

Appoint a US-Based Registered Agent

Prepare an LLC Operating Agreement (Optional)

File the LLC Articles of Organization

Apply for an Employer Identification Number (EIN)

Apply for a TIN number and SSN

Obtain the Required Licenses and Permits

Open a US-Based Business Bank Account

Keep Proper Records and File Annual Reports

Form your LLC as a US resident

Learn how to start your business in the USA if you are a US-resident. Detailed information is available here. As a US resident, a new LLC can be preferable for personal asset protection, flexible taxation, simplified operations, and enhanced credibility making LLCs an attractive option for businesses of all sizes and industries.

What are the steps of the LLC formation if you are a US resident?

Choose a Unique LLC Name

Use your U.S. address for your LLC or hire a Registered Agent

Prepare an LLC Operating Agreement

File LLC Articles of Organization

Apply for an Employer Identification Number (EIN)

Obtain Business Licenses and Permits

Open a Business Bank Account

Keep Proper Records and File Annual Reports

Which states are favorable to start an LLC?

Several states of the United States are particularly well-suited for both US residents and non-US residents seeking to form an LLC. These states typically offer favorable tax structures, streamlined business regulations, and robust protections for LLC owners. Here are three of the most popular states to form an LLC:

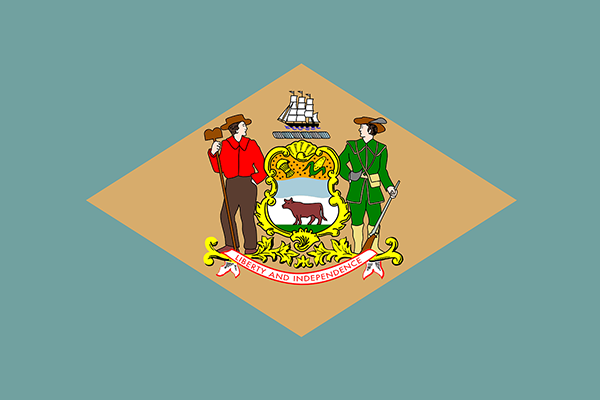

Delaware LLC

Delaware is consistently ranked as the top state for forming an LLC due to its strong legal framework, business-friendly environment, and limited disclosure of ownership information. The state’s favorable tax structure, particularly for pass-through entities like LLCs, also attracts non-US businesses.

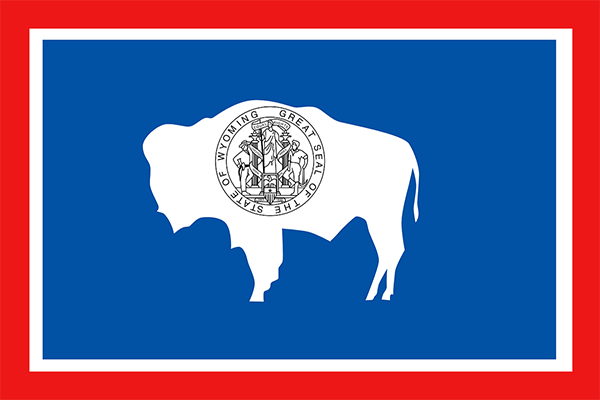

Wyoming LLC

Wyoming is another popular choice for non-US residents seeking to form an LLC. The state’s strong protections for LLC owners, coupled with its low annual fees, make it an attractive option. Wyoming also offers limited disclosure of ownership information, protecting the privacy of LLC owners.

New Mexico LLC

New Mexico offers several advantages for non-US residents, including a low state-income tax rate, limited liability protections, and a favorable tax structure for businesses with out-of-state income.

Choose LAVECO and simplify the process of forming an LLC

With our assistance, your business entity will stay compliant with all Federal and State of Incorporation regulations that apply to your business operations.

Choose the state where you want to start your LLC

Submit our price quote request form

Choose a unique name for your LLC

We'll start the pricess of incoproration

LAVECO's Pre-made packages for LLC formation at a reasonable price

Get the business formation package that suits your needs. Whether you’re looking for a basic package or comprehensive support, we provide all the essentials to initiate or expand your business successfully.

No posts found!

How much does an LLC cost?

With our 30+ years of experience and broad network of local contacts, we're confident in finding the best solution for your business needs in all US states. Our basic formation packages start from $0 + state filing fee (state filing fee depends on which state you choose). We recommend requesting a personalized price quote if you need more services for your new LLC (e.g. EIN, virtual office, preparation of the BOI report, etc.).

Request a Price QuoteAre you ready to start your LLC with LAVECO?

100% remote formation

No need to travel to the US. Hassle-free process with our professional assistance.

We care about your privacy

Secure your business with our reliable registered agent service, ensuring compliance and confidentiality.

Business address

Elevate your business presence with our prestigious and professional business address solutions.

Save Time

We will assist you with your company administration to avoid tedious paperwork; missed deadlines and associated fines; and or late filings penalties.

Experienced Team

Transparency is our commitment to you. We have 30+ years of industry expertise.

Lifetime Customer Support

Experience exceptional customer support tailored to your needs, because your satisfaction is our top priority.

FREQUENTLY ASKED QUESTIONS - LLC formation

You can learn more about LLC formation on our Frequently Asked Questions page.

An LLC is a business structure that combines the limited liability protection of a corporation with the simplicity and flexibility of a partnership. It offers personal liability protection to its owners (members) and pass-through taxation.

To form an LLC, you typically need to choose a unique name, file articles of organization with the state, designate a registered agent, and create an operating agreement outlining the company’s management and operational details.

Some advantages of an LLC include limited liability protection for members, pass-through taxation, flexibility in management and ownership, and ease of formation and maintenance.

The suitability of an LLC depends on various factors, including your business goals, liability concerns, and tax preferences. Consult with a legal or financial advisor to determine the best structure for your specific needs.

Yes, foreign nationals and entities are allowed to own and operate an LLC in the USA. However, they may be subjected to certain tax and reporting requirements.